Investing in stock is always exciting and daunting for the beginners. Every investor has to face one common challenge to manage their portfolios effectively, particularly in calculating the average price of their shares. This is where a Share average calculator tool can be helpful to investors.

Share Average Calculator

What is the Share Average Calculator?

The Share Average Calculator is also known as the stock average calculator tool which is used for calculating the average share price, total number of shares/stock, and total amount of investment. It is a valuable tool for investors and new beginners who are working in the finance and investment sector to manage their portfolios effectively and get investment strategies in an optimized way.

What is averaging in the stock market?

The averaging is a strategy in an investment where investors try to increase or decrease the number of shares to make a lesser average of the initial purchased price. However, there are two terms average up and average down both are used to increase profit and decrease losses in a portfolio and the average is considered as profit can be more. If you are sure about the future trend then this is the best strategy to make a profitable portfolio.

Average Down in the stock market:

Averaging Down is a term for buying more stocks when they rise more above their initial purchased price. Using this strategy investors can earn profit by decreasing average share price.

Let’s consider, that you have bought 10 shares of “A” stocks at values at the initial buying price of $80, and its price increases to $85. Now if a new investor tries to invest in the same stock, then its average price will be $85. But if you buy 10 more shares at $85 then the average price for you will be $82.5. Using this strategy you can decrease the average price of shares.

Average Up in the stock market:

Averaging Up is a term for buying more stocks when the price falls down to its initial purchased price. By using this strategy investors can increase average stock price with profit potential.

Let’s consider, that you have bought 10 shares of “A” stocks at values at the initial buying price of $80 and its price decreases to $75. Now if a new investor tries to invest in the same stock, then its average price will be $75. But if you buy 10 more shares at $75 then the average price for you will be $77.5. Using this strategy, you can increase the average price of shares and try to overcome losses.

Why Share Average Calculator important?

By understanding why averaging is an important term in the stock market, then investors know how can manage their portfolio. The share average calculator tool will help in such situations for calculation and getting ideas about future trade. This tool can help in both conditions like buying and selling to the investor. Averaging is one of the most popular methods which can handle investment in the stock market.

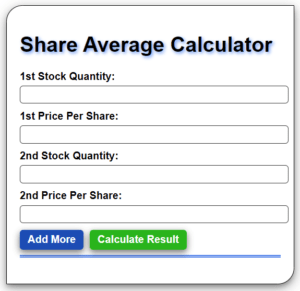

How to use the Share Average Calculator?

It is really easy and user-friendly. By the following step, you can use this tool.

STEP 1: Enter the Quantity of Shares/Stocks for price in the input box.

STEP 2: Now, if you want to add more then you can click on the “Add More” button and two new boxes will open for quantity and price.

STEP 3: For the calculation just click on “Calculate Result” and then the result of every term will be shown.

Benefits of Using a Share Average Calculator

Accurate Calculations: The share average calculator calculates the average price of your stock investments, eliminating the risk of manual errors.

Time-Saving: Instead of manually calculating the average, which can be time-consuming, you can make informed decisions quickly with the calculator, as it provides instant results.

Portfolio Management: You can make informed decisions quickly by knowing the average price of your stocks and using a calculator that instantly provides results.

Cost-Effective: Using a share average calculator is cost-effective, as it reduces the need for hiring financial experts to perform these calculations.

Uses of a Stock Average Calculator

Cost Basis Calculation: Investors use the calculator to determine the average price per share of their stock holdings, which is crucial for tax purposes.

Portfolio Tracking: The calculator helps investors track their stock portfolio’s performance by providing their stocks’ average price over time.

Decision Making: Investors use the calculator to make informed decisions about buying or selling stocks based on their average price.

How does the Share Average Calculator work?

The share average calculator works by taking the total cost of all stock purchases and dividing it by the total number of shares purchased. The formula for calculating the average price per share is as follows:

Average Price per Share = (Total Cost of Shares Purchased) / (Total Number of Shares Purchased)

For example, if you purchased 100 shares of a stock at $10 per share and later purchased 50 more shares at $15 per share, the calculation would be as follows:

Total Cost of Shares Purchased = (100 * $10) + (50 * $15) = $1000 + $750 = $1750

Total Number of Shares Purchased = 100 + 50 = 150

Average Price per Share = $1750 / 150 = $11.67

In this example, the average price per share of your stock investments would be $11.67.

You can check about the best stock for investment currently in the market. And detail about averaging of stock investment.

Conclusion

For investors, sometimes it is difficult to manage their stock effectively the share average calculator tool can be very valuable. It provides accurate calculations of average share price but also saves time and reduces the risk of errors. If investors understand how the calculator works and its benefits, then it can help to make decisions about their stock investments and get better financial outcomes.